![]() ΔMP & Σ(ΔMP) -Discover the Latest Technical Indicator by TradingCenter and G. Protonotarios

ΔMP & Σ(ΔMP) -Discover the Latest Technical Indicator by TradingCenter and G. Protonotarios

TradingCenter is continuously striving to provide the trading community with innovative technical analysis tools and techniques. The goal is to help traders better analyze financial markets and gain a clearer understanding of the cyclicality present in certain asset classes. ΔMP is the latest technical analysis tool developed by Giorgos Protonotarios. It is an indicator that can be applied to any financial asset and is compatible with nearly any chart timeframe.

🎬 Introducing ΔMP -Measuring Momentum using Historical Intraday Ranges

In my latest eBook, I introduced the ΔMP and Σ(ΔMP) technical analysis indicators. The purpose of ΔMP is to measure and visualize the historical momentum of any Forex pair or other financial-traded asset. The book can be found here.

In my latest eBook, I introduced the ΔMP and Σ(ΔMP) technical analysis indicators. The purpose of ΔMP is to measure and visualize the historical momentum of any Forex pair or other financial-traded asset. The book can be found here.

💡 Forming ΔMP:

ΔMP is derived by summarizing the historical divergence between closing prices and intraday ranges.

⚙️Explaining the Formula:

The ΔMP algorithm calculates the divergence between the Closing Price and the Mean Price daily. These daily results are then summarized to generate meaningful indications.

□ Where:

Mean Price = (Daily High + Daily Low) / 2

ΔMP = {(Closing Price – Mean Price) / Mean Price} × 100%

⭐ The Importance of ΔMP

ΔMP measures the divergence between the closing price and the mean price. Consecutive positive ΔMP values indicate that an asset’s price consistently closes near its highest intraday level. This signals strong positive momentum in intraday demand and supply dynamics. Generally, when ΔMP remains highly positive over a period, the likelihood of favorable returns during that period increases.

Let’s take GBPUSD as an example.

In the following GBPUSD chart, two variables are shown:

(i) The blue line represents the average monthly returns of GBPUSD from 2000 to 2018.

(ii) The orange area represents the average monthly ΔMP over the same period.

Chart: Average Returns & Average ΔMP on GBPUSD (period 2000–2018)

📌 Observations:

(1) The average returns and ΔMP almost always move in the same direction.

(2) The chart reveals a strong seasonality for GBPUSD, particularly in February and April.

📈 Unique Charting using Σ(ΔMP)

ΔMP is also used to create momentum charts by summing historical ΔMP values to form Σ(ΔMP) as follows:

□ Σ(ΔMP) for N Periods

□ ΔMP(N) = {(Closing₁ – Mean₁) / Mean₁ × 100%} + {(Closing₂ – Mean₂) / Mean₂ × 100%} + … + {(Closingₙ – Meanₙ) / Meanₙ × 100%}

Σ(ΔMP) Charting – Example on EURUSD and USDJPY

The following chart areas display Σ(ΔMP) for two popular Forex pairs, EURUSD and USDJPY.

👉 Example 1: EURUSD

Starting with a EURUSD weekly chart covering 1995–2018, alongside a Σ(ΔMP) chart spanning 2000–2018.

Chart Area 1: EURUSD Weekly 1995–2018 plus Σ(ΔMP) 2000–2018

📌 Observations:

(1) Remarkably, the Σ(ΔMP) chart closely mirrors the weekly EURUSD chart over the same period. This highlights the importance of evaluating periodic momentum and its crucial role in driving strong price movements.

(2) A closer look at the Σ(ΔMP) chart reveals the formation of a general support level (AB line) that later turns into a resistance level.

👉 Example 2: USDJPY

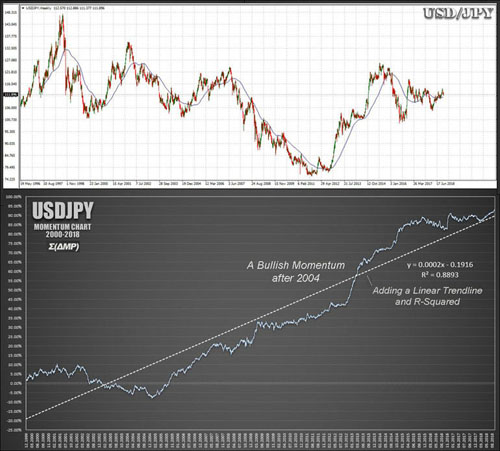

The following chart area shows a USDJPY weekly chart covering 1996 to 2018, alongside a Σ(ΔMP) chart for a shorter period from 2000 to 2018.

Chart Area 2: USDJPY Weekly (W1) & Σ(ΔMP)

📌 Observations: Regarding Σ(ΔMP):

(1) The above Σ(ΔMP) chart includes a linear trendline (R² = 0.8893); the higher the R-squared, the better the model fits the data.

(2) The linear trendline appears to act as a support/resistance line, which is quite unusual.

(3) After 2004, the Σ(ΔMP) chart shows a strong bullish formation for USDJPY, possibly reflecting differences in growth rates between the US and Japan, as well as interest rate differentials between the two economies.

ℹ️ More About ΔMP & Σ(ΔMP)

-

Trading signals incorporating ΔMP and Σ(ΔMP) will be available at TradingCenter.org.

-

My latest ebook features the full scope of ΔMP along with over 100 charts, and it is available on Amazon. 🔗 More: ► MY BOOK AT AMAZON INCLUDING FULL ΔMP EXAMPLES & KEY FOREX TRADING STATISTICS

■ ΔMP & Σ(ΔMP) -Τhe Latest Technical Indicator by TradingCenter

Giorgos Protonotarios, Financial Analyst (2018)

for TradingCenter.org (c)

L MORE ON TECHNICAL ANALYSIS • COMPARE • TECHNICAL ANALYSIS • INDICATORS • CYCLICAL ANALYSIS • LEARNING

□ Forex Brokers Comparison

□ Expert Advisors (EAs)

□ Broker Reviews

□ Learning

» Technical Analysis Guide

» Trading Chart Patterns

» Naked Charts & Price Zones

» Forex Technical Analysis

» Fibonacci Primes Sequence

» Harmonic Price Patterns

» RSI Precision

» PriceMomentum Chart

» CVD Indicator

» Key Technical Indicators

» ΔMP and Σ(ΔMP) Indicators

» Wyckoff Method

» TD Sequential

» Hurst Nominal Cyclical Model

» Elliott Wave Principle

» Forex Pairs

» Trading Books

» Trading Tips