Rating Formula v5.0 – Rating Forex Brokers by Three (3) Different Trading Styles

Rating Formula v5.0 – Rating Forex Brokers by Three (3) Different Trading Styles

“The most advanced Rating Formula ever built by TradingCenter”

✨ Preface: The Need for a 100% Objective Rating Framework

The Rating Formulas developed by Giorgos Protonotarios and TradingCenter.org introduce a new way of evaluating financial services. Today, most broker ratings found online are based on user reviews. Research shows that more than 50% of these reviews are fake. Brokers often have strong incentives to pay for fake positive reviews or negative ones against their competitors.

This series of Rating Formulas aims to solve that problem by offering a 100% objective framework for evaluating brokers. So far, two categories of financial services have been rated: Forex Brokers and Binary Options Brokers. The new Rating Formula v5.0 is specifically designed for Forex Brokers, featuring several important innovations.

🆕 What’s New in Version 5.0 of the Rating Formula:

(i) The number of core rating factors has been reduced to three focused categories to improve clarity and relevance:

1. Safety of Funds

2. Transaction Cost

3. Trading Options & Technology

(ii) Version 5.0 puts more weight than ever on transaction cost (40%) and introduces new rating elements, including SWAP charges and Stop Levels.

(iii) What sets version 5.0 apart is that, for the first time, it delivers ratings based on three different trading styles: Intraday Traders, Swing Traders, and Long-Term Traders.

(iv) The formula now produces four separate rating values:

-

One for each trading style (Intraday, Swing, Long-Term)

-

One Overall Rating, calculated as the average of the three.

(v) The first rating factor—Safety of Funds—is common to all trading styles. However, the other two factors—Transaction Cost and Trading Options & Technology—are calculated separately for each style. This makes the ratings more precise and better aligned with the needs of different types of traders.

For example:

-

SWAP charges matter a lot to long-term traders but are irrelevant to intraday traders.

-

Slippage and Stop Order Distance are crucial for intraday traders but have little impact on long-term traders, who trade infrequently and leave wider stop-loss margins.

Rating Formulas History:

|

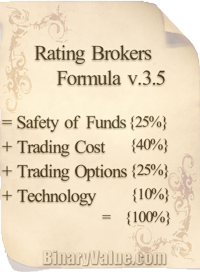

📌 Rating Formula v4.0 for Rating Forex Brokers | » Forex Rating Formula 4 (TradingCenter.org) 📌 Rating Formula v3.5 for Rating Binary Options Brokers | » Rating Formula V.3.5 (TradingCenter.org) 📌 Rating Formula v2.0 for Rating Forex Brokers | » Rating Formula 2 (TradingCenter.org) 📌 Rating Formula v1.0 for Rating Forex Brokers | (OnlineForex.Biz) |

- Rating Formula Mission: “Ensure Fund Safety, Minimize Transaction Costs, and Use State-of-the-Art Technology”

What is it about?

What is it about?