The terms “smart money” and “dumb money” describe different types of market participants. Institutional investors and market insiders are called smart money, while small retail traders and short-term speculators are called dumb money. Dumb money often buys and sells at the worst times, so it can be profitable to trade against it.

Understanding Smart and Dumb Money

There are many ways to define smart and dumb money in global financial markets. Generally, smart money refers to investments made by people with deep market knowledge. These may include successful hedge fund managers, wealthy individuals, or insiders with access to privileged information. Dumb money, on the other hand, usually refers to retail investors with limited market knowledge.

☑ Dumb money often follows exhausted trends and uses high leverage.

☑ Retail traders and small speculators are commonly considered dumb money.

☑ According to statistics over a two-decade period, the average retail investor underperformed the market by 2.75% per year.

Overall, the goal of each trader should be to align with Smart Money (hedge funds, institutional investors, market experts, insiders) and take a contrarian approach to Dumb Money (retail traders, leveraged traders, small speculators). The following analysis highlights tools that can help traders track the movements of smart and dumb money.

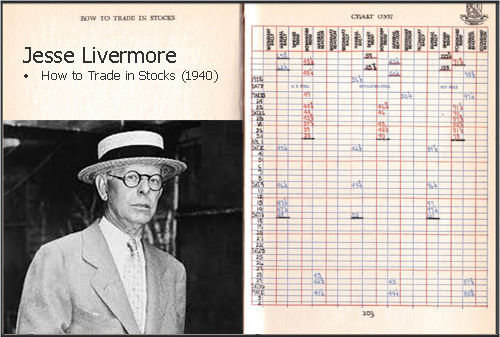

Applying Gann’s Law of Vibration in Financial Markets

Applying Gann’s Law of Vibration in Financial Markets

Investing is a triangle formed by three axes: (i) return, (ii) risk, and (iii) time. Whenever you push on one of these axes, the other two are affected. This means that in any investment:

Investing is a triangle formed by three axes: (i) return, (ii) risk, and (iii) time. Whenever you push on one of these axes, the other two are affected. This means that in any investment: